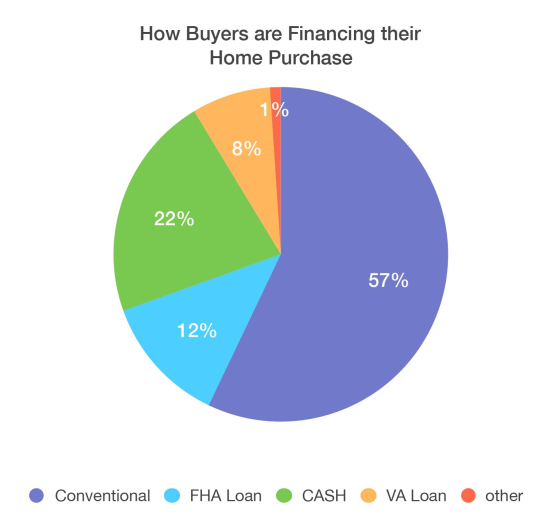

Financing Your Home Purchase

Before you actually start looking at homes, the first step is always to talk to a mortgage professional and get pre-approved.

(NOTE: Getting pre-qualified is not an optional step. All offers to purchase a home in Arizona must be accompanied by a AAR PRE-QUALIFICATION FORM completed by your mortgage

lender.)

Reasons NOT to use an out-of-state or online Lender;

1. As mentioned above, an AAR PRE-QUALIFICATION FORM is required to completed by your mortgage lender. Out-of-state or online lenders are not familiar with this required form. They will try to provide a pre-qualification letter on their form. This is not adequate in Arizona.

2. Another form that is required in Arizona is the Loan Status Update (LSU) form. The lender should provide an updated version of this LSU form to the parties once a week during the transaction showing the progress of your financing. Out-of-state or online lenders are also not familiar with this required form. Failure to provide this required form could result in your breach of Contract.

ALWAYS work with a good, local loan officer.

Here is my list of

Preferred Lenders in the local area:

Heather Sorensen-Humphreys Licensed Mortgage Professional

Homeowners Financial Group / NMLS # 215869

cell phone: (480) 650-6441

email:

heather@homeownersfg.com

website:

www.homeownersfg.com/heatherhumphreys

Scott Kobashi Senior Mortgage Banker

Barrett Financial / NMLS # 213610

cell phone: (602) 430-4262

email:

SKobashi@barrettfinancial.com

website:

www.BarrettFinancial.com

Torger Erickson Area Sales Manager

Bay Equity Home Loans / NMLS # 167957

cell phone: (480) 766-1201

email:

terickson@bayeq.com

website:

www.BayEquityHomeLoans.com

Jared Paul Area Sales Manager

CrossCountry Mortgage, LLC / NMLS #974114

cell phone: (714) 474-4505

email:

Jared.Paul@ccm.com

website:

crosscountrymortgage.com/jared-paul/

U.S. Marine Corps Veteran

Specialist in VA (Veterans) financing

Scott Harward Mortgage Broker/Banker, Arizona Manager

United American Mortgage Corp. / NMLS # 188539

cell phone: (480) 223-2265

email:

sharward@uamco.com

website:

www.HarwardMortgageTeam.com

Conv, FHA, VA plus Reverse Mortgages and Down Payment Assistance financing.

Also licensed in several other states. Contact Scott for details.

Simply contact any of these preferred mortgage professionals and tell

them you want to start looking at homes and you need to get

pre-qualified. (Mention you are working with Ward Stone.) They will ask you a few questions, then walk you through

the financing process and answer any questions you have.

PRE-QUALIFICATION TIP -

Your Pre-Qualification from the Loan Officer should NOT be on a specific property. This is a common mistake. The Pre-Qualification should always be on the maximum loan amount YOU can qualify for.

For example, if you are looking to buy a home and finance $400,000, but you can qualify for a loan up to $500,000. Your Pre-Qualification should be for the $500,000 amount, NOT the $400,000. Why? Because in that scenario, if your Pre-Qual shows $400,000 it will look to the Seller that you can JUST BARELY afford to buy the home. However, if you are financing $400,000 but can qualify for up to $500,000 you will look like a MUCH stronger buyer and that will give us more leverage in negotiating. (This is especially true if there is more than one offer on the home.)

So when talking to the Loan Officer, don't get caught up in talking about a specific home. YOU are getting pre-qualified, NOT a house.

Do you need to have a 20% down payment to buy a home? The answer is NO. However, if you are able, there are several benefits to at least a 20% down payment. Contact any of the mortgage professionals above for more details.

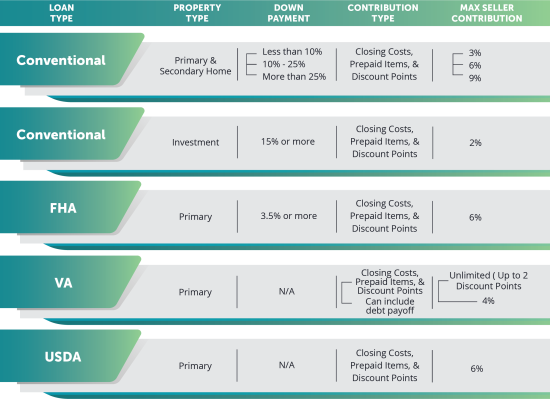

Seller Contributions:

Seller Contributions: How much is allowed

NOTE: This is as of 04/2024. The numbers shown on this chart are constantly changing.

Always discuss this with your Loan Officer for current lending limits.

(See Preferred Lenders above.)

Reverse Mortgages

With a reverse mortgage, those age 62 and older can have access to an FHA insured loan designed to help them buy their next home or refinance their current home with one initial investment, without having monthly mortgage payments. Though the borrow needs to be the primary occupant of the house, they won’t need to repay the loan until they no longer use the home as their principal residence or fail to meet the obligations of the mortgage.

Because of this leniency, more cash flow can be freed up for retirees to use toward medical expenses and house upkeep, among other necessities. The borrower also has convenient options to access these funds including taking a line of credit, a lump sum, or monthly payout.

For more information on a reverse mortgage, contact one of these professionals;

Scott Harward Mortgage Broker/Banker, Arizona Manager

United American Mortgage Corp. / NMLS # 188539

cell phone: (480) 223-2265

email:

sharward@uamco.com

website:

www.HarwardMortgageTeam.com

Jared Paul Area Sales Manager

CrossCountry Mortgage, LLC / NMLS #974114

cell phone: (714) 474-4505

email:

Jared.Paul@ccm.com

website:

crosscountrymortgage.com/jared-paul/

U.S. Marine Corps Veteran

Scott Kobashi Senior Mortgage Banker

Barrett Financial / NMLS # 213610

cell phone: (602) 430-4262

email: SKobashi@barrettfinancial.com

website: www.BarrettFinancial.com

This communication is provided to you for informational purposes only and should not be relied upon by you. RE/MAX is not a mortgage lender and so you should contact the Mortgage Professional shown directly to learn more about its mortgage products and your eligibility for such products.

This communication is provided to you for informational purposes only and should not be relied upon by you. RE/MAX is not a mortgage lender and so you should contact the Mortgage Professional shown directly to learn more about its mortgage products and your eligibility for such products.